Blogs

Read our latest news and industry insights.

Investment Fees

By Ruvan J Grobler

•

November 29, 2024

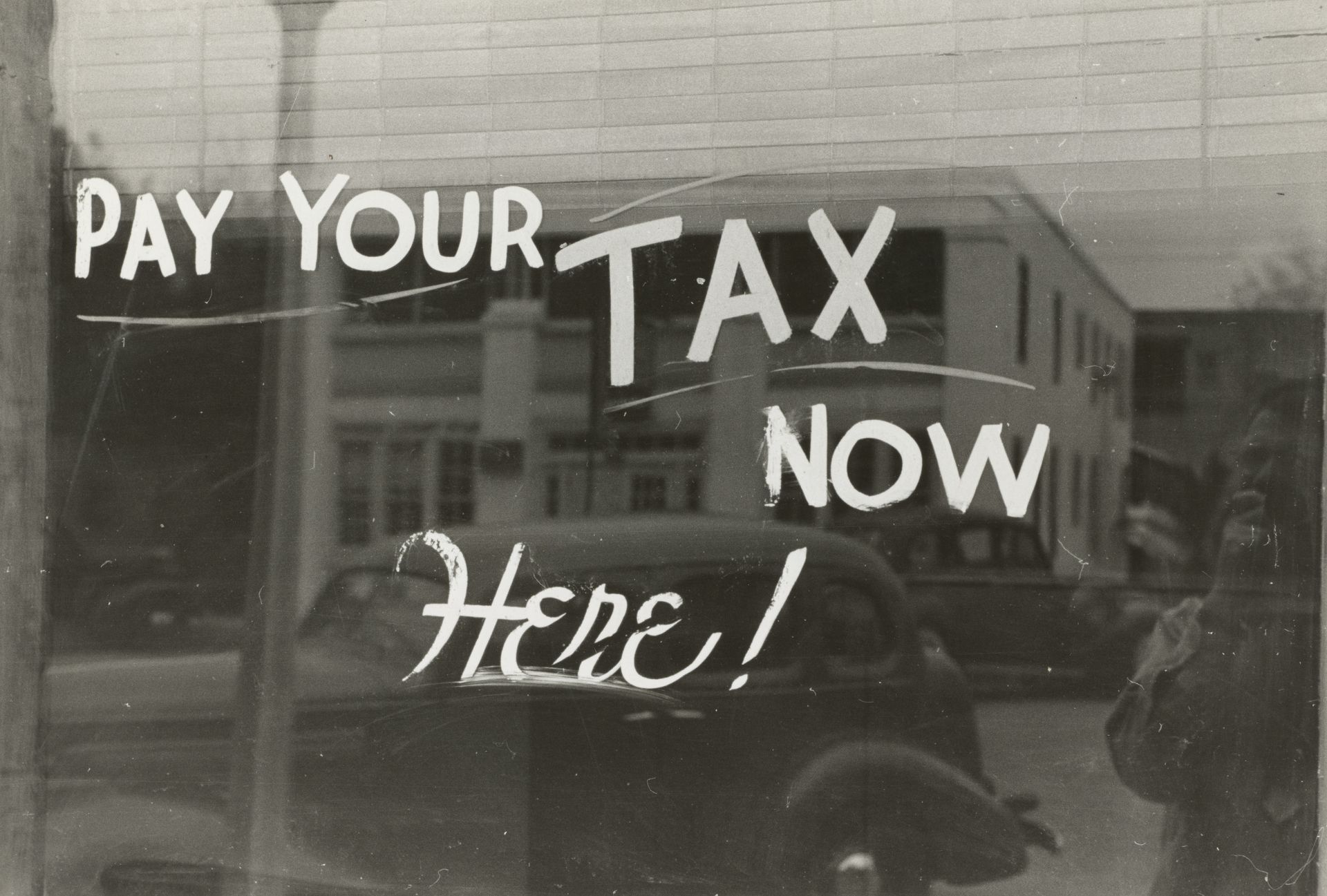

After the COVID lockdowns, the SARB pushed up interest rates to fight rising inflation. This made money market rates rise and investors rushed to take advantage. Billions were moved from shares into savings account even though share prices and dividend growth were on the horizon. Many South African investors choose to earn interest through bank savings and fixed deposits but neglect to take taxes into account. Interest earnings are taxed as income, effectively increasing your taxable income. A shock to many when their tax returns are due. SARS does however give you a small annual exemption on interest earnings: Under 65 years of age – The first R23 800 of interest income is exempt. 65 years of age and over – The first R34 500 of interest income is exempt. Here is an example to illustrate the post-tax rate and pay out for three different income tax rates. The conclusion being that high earners should be careful of interest earnings.

HEAD OFFICE

Menlyn Corporate Park, Block C

175 Corobay Avenue, Waterkloof Glen, Pretoria

012 998 6428

NAVIGATION

©COPYRIGHT BOVEST. ALL RIGHTS RESERVED. BOVEST WEALTH MANAGEMENT PTY (LTD) IS AN AUTHORISED FINANCIAL SERVICES PROVIDER FSP Nr. 35064

We use cookies to ensure that we give you the best experience on our website. To learn more, go to the Privacy Page.

×