Blogs & News

Read our latest news and industry insights.

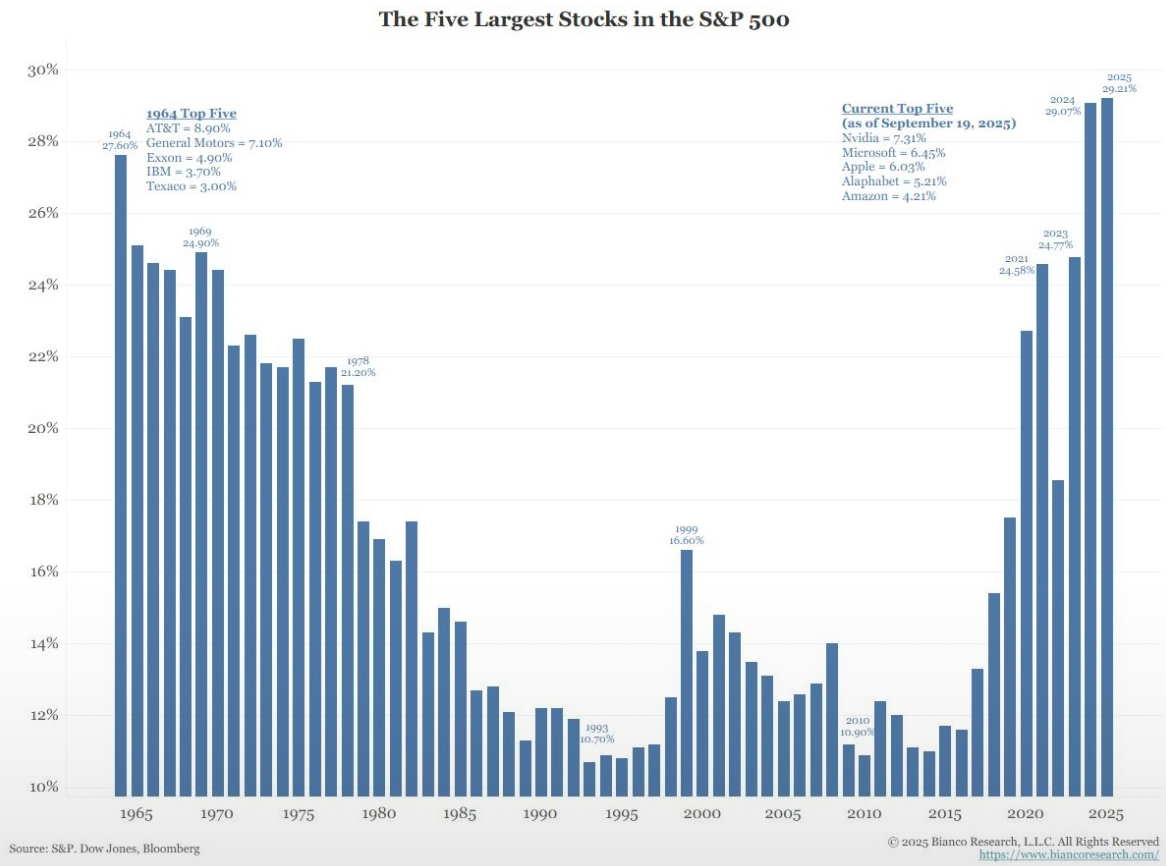

In this month’s chart we can see that over the last 60 years, top five stocks now make up nearly 35% of the US market — the highest concentration on record. They include: Nvidia, Microsoft, Apple , Alphabet (Google) and Amazon. Market leadership is becoming increasingly narrow, leaving investors more exposed if these giants stumble. At Bovest we take this into consideration when constructing our client’s portfolios and it serves as a reminder of the risks of concentration and the value of diversification. Although almost every investor will have exposure to these large tech companies in one way or another, it is important to limit the level of exposure and not get caught into investing in themes or falling in love with a certain stock. At a recent event, hosted by pour partners at Ninety-One asset managers, many of the talks still revolved around the impact of AI, not only in the workplace, but investment opportunities as well. This boasts the idea that these stock might still have room to grow, but at a certain point valuations move across the tipping point, and we will see a correction in prices. Kindly contact our team if you have any questions.

In many instances, spouses choose to bequeath their whole estate to each other and the surviving spouse will look after the children. This is also good estate planning. But what will happen to the children and assets should both parents pass away? Underage children can inherit these assets but should be managed through a testamentary trust. A short video summary of the below can be watched here: https://www.instagram.com/reel/DPOqkx3DP1S/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA== What Is a Testamentary Trust? A testamentary trust is a legal entity created in terms of a person’s Will, which only comes into effect upon their death. Unlike inter vivos trusts, it is not operational during the testator’s lifetime. The Will serves as the trust instrument, and the testator is the founder. How Is It Created? Drafting the Will: The Will must clearly state the intention to create a trust, name the beneficiaries, identify the assets to be placed in trust, and outline the terms and conditions. Activation: Upon death, the nominated trustees apply to the Master of the High Court for Letters of Authority to manage the trust. Trustees: It’s advisable to appoint at least one independent trustee with fiduciary expertise to ensure proper governance. Why Should Clients Consider It? Protection for Minor Children: Minors cannot legally inherit until age 18. A testamentary trust ensures their inheritance is managed responsibly until they reach maturity. Special Needs Planning: A Type A Special Trust offers tax-efficient support for beneficiaries with disabilities. Asset Preservation: Prevents reckless spending by beneficiaries. Trustees manage and distribute assets according to the testator’s wishes. Managing Indivisible Assets: Useful for assets like farms or holiday homes that cannot be easily split among heirs. Tax Efficiency: Testamentary trusts may offer tax advantages, especially in the case of special trusts. Important Considerations Validity of the Will: If the Will is invalid, the trust cannot be established. Professional drafting is essential. Trustee Selection: Trustees must be trustworthy, capable, and ideally include an independent party to avoid conflicts. Costs & Complexity: Testamentary trusts involve legal and administrative costs. Clients should be made aware of ongoing compliance and management responsibilities. Family Dynamics: Clear communication and transparency in the Will can help prevent disputes among beneficiaries. Contact me at ruvan@bovest.co.za for more information. Ruvan J Grobler RFP™ (PGDip Financial Planning)

For a long time, the South African Reserve Bank (SARB) prohibited money from being transferred directly from local trusts to offshore trusts. You may have had offshore exposure in your local trust through asset swops and other investment vehicles, but if you want to distribute to overseas beneficiaries, you must first withdraw funds from the trust and then transfer to them through the SARB. This recently changed. SARS declared that beginning August 1, 2023, it will evaluate and possibly approve petitions to transfer funds from South African trusts to offshore trusts. This adjustment coincides with the South African Reserve Bank's (SARB) recent relaxation of several currency control regulations. While this new alternative provides numerous prospects, there are tight criteria and a thorough application process. If you are an investor or trustee, you must understand these requirements. There is certainly no one-size-fits-all answer, and the drawbacks and benefits should be examined while deciding. Drawbacks: 1. Complex Regulatory Requirements. • Strict compliance required: The procedure is extensive, necessitating meticulous documentation and adherence to both SARS and SARB regulations. • Long approval process: Each application is assessed individually, which can take weeks or even months. 2. Cost • Legal, tax, and accounting assistance can be costly. • Administrative burden: Extensive documentation and regular reporting increase management time and expenses. 3. Tax obligations • The South African trust must pay all relevant taxes (capital gains, dividends, etc.) before distribution, preventing tax deferral to the recipient. Money held in a trust is often taxed at a higher rate than money held in the name of a company or individual. 4. Uncertainty and Evolving Practice • New regulations may impact future distributions and compliance needs. • Disputes: Failure to meet SARS or SARB rules may result in delayed or refused distributions. Benefits: 1. Global Wealth Diversification. Offshore trusts may provide superior asset protection during political or economic volatility in South Africa. 2. Succession and Estate Planning • Multi-Jurisdictional Estate Planning: This allows families with members living in different countries to structure their affairs more efficiently. • Offshore trusts facilitate the transfer of money to beneficiaries outside South Africa, simplifying inheritance processes. 3. Tax preparation • Offshore trusts can optimise worldwide tax positions with proper preparation and professional counsel, but must follow all applicable requirements. 4. Regulatory Clarity • Official Approval: SARS and SARB now provide clear protocols for trustees and investors, eliminating legal risks. The ability to transfer money from a South African trust to an offshore trust is a useful tool for global estate and investment planning. Professional guidance is essential to maximise benefits and avoid pitfalls.

’n Nuwe denke oor ouderdom. ‘n Positiewe benadering oor verouderdom word gevorm as gevolg van die ontwikkeling van tegnologie en die mediese wetenskap. Statistieke wys dat die mens langer neem om te verouder en op ’n hoër ouderdom afsterf. Met veroudering word nuwe perspektiewe oor verhoudings met familie en vriende gevorm. ’n Groter dringendheid bestaan om beplanning uit te voer. Daar is ’n besef dat die tyd aanstap en dat elke oomblik geniet moet word. Die gewoonte om uit te stel en eers later belangrike momente in jou lewe te wil ervaar, verander. Daar is ’n besef dat die liggaam verouder maar dat die innerlike self steeds wil vernuwe. Laasgenoemde kan aangehelp word deur positiewe denke en gewoontes soos om terug te gee aan die plaaslike gemeenskap, om kennis te deel deur om te skryf of om onderrig te gee. Daar kan selfs oorweeg word om ’n nuwe vaardigheid aan te leer. Een van ons kliente wat ’n afgetrede predikant is, het na aftrede begin om klavierlesse te neem terwyl ander persone ’n nuwe plaaslike taal aangeleer het. Mediese kostes Volgens Stats SA se verslag “Profile of older persons in SA” wat in 2023 gepubliseer is, het die gedeelte van die SA bevolking wat ouer as 60 jaar is, verhoog van 7,0% in 1996 tot 9,8% in 2022. Wanneer die bevolking per groep ontleed word, maak die 60 jaar en ouer gedeelte van die betrokke groep die volgende uit: Blankes ongeveer 29%, Indiërs/Asiate 16,5%, Kleurlinge 10,9% en Swartes 7,8%. Hiervan gebruik ongeveer 50% kroniese medisyne, 20% gebruik brille, 10% dra gehoortoestelle en 5% is in rolstoele.Hierdie ondersteunende toestelle is duur en word nie altyd ten volle deur mediese fondse betaal nie. Die verslag noem ook dat meer as 50% van persone ouer as 60 leef in huishoudings wat uitgebreide families huisves. Mediese uitgawes is seker een van die belangrikste items in ’n afgetredene se begroting. Dit is ’n ongelukkige verskynsel dat mediese kostes met ouderdom verhoog. Die koste van ’n mediese fonds verhoog jaarliks met 3% tot 5% meer as die inflasiekoers en sal ’n al groter persentasie van ons persoonlike uitgawes vereis. Om die regte mediese fonds volgens persoonlike mediese kondisies te kies, speel ’n belangrike rol om deurlopende mediese uitgawes te beperk. Gap Cover kan ’n belangrike rol speel wanneer mediese fondsvoordele nie al die werklike mediese uitgawes dek nie. ’n Versekeringsproduk wat sal uitbetaal wanneer een van die gevreesde siekte opgedoen word, kan ook help om onverwagte mediese uitgawes te dek. RIAAN BOTHA

Debt is often used in case of emergencies but can also be used as leverage to finance the purchase of assets that would otherwise be out of reach. In the case of good- and bad debt, the repayment strategy will help manage cashflow and lower the costs of borrowing. The aim of this article is to help you pay of good debt earlier but may also help those individuals who are under pressure due to debt, to take control of the situation. It is important firstly to have a comprehensive budget that gives a framework for your spending. This helps you keep track of your cashflow and discourages your emotions from taking over. Before taking out any debt, emergency funds and insurance must form part of your plan. Avoid taking out new debt if it does not fit into the current plan and budget. Why it’s important to have a structured plan for repaying debt: Paying more interest over time : Only paying “what you can, when you can,” your payments might be too small or irregular. The debt repayment takes too long, and you pay more in interest. No clear end date : A plan lets you see exactly when you’ll be debt-free, which can be motivating and helps you track progress. Poor prioritisation : Not all debts cost the same. A structured plan ensures you pay off high-interest or priority debts first. Easier budgeting : Knowing exactly how much you’ll pay each month helps you manage cash flow and identify opportunities for extra repayments. Better discipline and accountability : A structures plan helps to remove any guesswork and prevents emotional spending or skipping of any payments. Repayment Strategies: Snowball Method How it works: List debts from smallest to largest balance. Pay minimums on all and put any extra money into smallest debts first. Positive: Quick wins from paying off small debts early give motivation to keep going. Negative: You might pay more interest over time compared to other methods. Avalanche Method How it works: List debts by interest rate, highest first. Pay minimums on all and put extra money toward the highest-interest debt. Positive: Saves the most on interest and often pays off debt faster overall. Negative: May take longer to see your first “win,” which can be demotivating for some. Debt Consolidation How it works: Combine multiple debts into a single loan (often at a lower interest rate). This could be a personal loan, balance transfer credit card, or home equity loan. Positive: Simplifies payments into one bill and can reduce interest costs. Negative: If you keep borrowing after consolidating, you could end up in deeper debt. Refinancing How it works: Replace an existing loan (e.g., bond, car loan) with a new one at better terms. Positive: Can lower monthly repayments and interest. Negative: Extending the term may cost more in interest over the long run. Ruvan J Grobler RFP™ (PGDip Financial Planning)

The date was 26 October 2007 and the S&P 500 index was gaining some momentum after a couple of years of sluggish growth. The index was at $1535. The housing crisis hit, and the index fell off a cliff. On the 31 st of January 2020, the world started panicking because the corona virus started spreading like wildfire. On the 10 th Dec 2021 markets started getting shaky with the rumours of a Russian-Ukraine invasion. All these events had a big impact on the S&P 500 index, some more than others. Markets took close to 6 years to recover from the housing crisis. It took close to two and a half years to recover from the Covid crisis and a year and a half to recover from the impact of the Russian-Ukraine invasion. What was the pleasure from holding on to your investment? If you invested 2007, your return is 315%. If you invested in 2020, your return is 97% If you invested in 2021, your return today is 35%. These investments assume that you were unlucky enough to have invested at the top of the index and right before the decline. Always remember this. One cannot time the market, but given time, your investment will generate returns. It is up to you how much you can stomach. Don’t wait for markets to recover before you invest, as the opportunities present themselves during times of unrest and uncertainty.

Inleiding Aftrede is onteenseglik ’n belangrike fase in jou lewe, en waarskynlik die belangrikste. Dit is die samevoeging van voorafgaande fases, soos opleiding en inkomsteskepping, en as persone nie gereed is vir aftrede nie, kan die lewe traumaties wees. Daar bestaan talle onsekerhede tydens aftrede soos die lengte daarvan, gesondheid en beskikbare finansies. Raad aan persone wat beplan om af te tree, is om tydig met die welvaart beplannings proses te begin – hoe gouer hoe beter. Jy benodig persoonlike welvaart doelwitte wat opgevolg moet word met die begeerte om die regte gewoontes aan te leer. Dit word soms vereis dat jy bereid moet wees om van jou gevestigde gewoontes te verander in die soeke na persoonlike geluk. Uit ons interaksie met kliënte wat op aftrede staan of reeds afgetree het, kon ons waarneem dat hierdie benadering prakties en logies is, met positiewe, tasbare gevolge. Hier volg ’n paar gedagtes oor welvaart gewoontes waarvan die leser kennis moet neem. ’n Nuwe denke oor ouderdom. ‘n Positiewe benadering oor verouderdom word gevorm as gevolg van die ontwikkeling van tegnologie en die mediese wetenskap. Statistieke wys dat die mens langer neem om te verouder en op ’n hoër ouderdom afsterf. Met veroudering word nuwe perspektiewe oor verhoudings met familie en vriende gevorm. ’n Groter dringendheid bestaan om beplanning uit te voer. Daar is ’n besef dat die tyd aanstap en dat elke oomblik geniet moet word. Die gewoonte om uit te stel en eers later belangrike momente in jou lewe te wil ervaar, verander. Daar is ’n besef dat die liggaam verouder maar dat die innerlike self steeds wil vernuwe. Laasgenoemde kan aangehelp word deur positiewe denke en gewoontes soos om terug te gee aan die plaaslike gemeenskap, om kennis te deel deur om te skryf of om onderrig te gee. Daar kan selfs oorweeg word om ’n nuwe vaardigheid aan te leer. Een van ons kliente wat ’n afgetrede predikant is, het na aftrede begin om klavierlesse te neem terwyl ander persone ’n nuwe plaaslike taal aangeleer het. Leef Gesond Ons ervaring by Bovest is dat talle persone die regte gesondheids gewoontes aanleer om hoë mediese kostes te beperk. Hier is verskillende gewoontes wat aangeleer kan word: Eet gesond en moenie oorgewig wees nie. Doen gereelde oefeninge soos op te stap. Beskerm jou gewrigte en beenstruktuur deur krag- en rek-oefeninge te doen. Hou jou brein-funksie of kognitiewe vermoë in ’n goeie toestand deur brein-oefeninge soos memorisering te doen. Volg ’n aktiewe sosiale lewe. Studies het getoon dat mense met ’n aktiewe sosiale lewe minder geheue-probleme ontwikkel. (Health Connection, Cooper, University Health Care, 9 September 2024). Samevatting Die persoonlike gewoontes van gelukkige afgetredenes is anders as die van die angstige en getraumatiseerde afgetredenes. Sommige van hierdie gewoontes word oor ’n lang tyd gevorm, terwyl ander makliker aangeleer word.

Your estate plan evolves as you get older and regular revision of beneficiary nominations on appropriate investments structures becomes a key planning tool. A holistic financial plan is the roadmap to executing these essential estate planning decisions. Let’s explore the importance of beneficiary nominations on your retirement annuity, pension-, provident or preservation funds. Estate Planning: Availability of funds: If the beneficiary nomination is valid, the death benefit will flow directly from the insurer to the beneficiary. This process can be much quicker than the process of winding up the estate. The death benefit can be paid to beneficiaries before other distributions from the estate is made. Estate related fees: By nominating valid beneficiaries, there is no capital inclusion in the deceased’s estate for estate duty and executor fees. This makes it an effective planning tool in reducing the size of the estate and related fees. Estate duty (SARS): 20% of the dutiable estate after R3.5mil and 25% after R30mil. Executor’s fees: Maximum of 4.025% (Including VAT) of the deceased estate. Very Important note: Section 37C of the Pension Funds Act regulates the payment of death benefits. The act aims to identify dependants of the deceased and ensure that death benefit payments are made to them. The trustees appointed by the fund must identify these dependants irrespective of who was nominated by the deceased. The trustees have a duty to conduct a thorough investigation to ensure equitable distribution of death benefits and rely on the financial advisor to provide relevant facts. What if no beneficiaries are nominated? The above process will still follow but it could then be possible that a determination is made to pay the death benefit to the deceased’s estate. The capital will then form part of the estate for purposes of estate duty and executor’s fees. This may also be an intentional decision in order to provide cashflow in the estate for estate related costs or debt. There are however better options in planning for estate cashflow needs. The above is not financial advice and serves only as factual information. Make sure these nominations align with your long-term financial goals and estate planning by consulting with your financial advisor. Ruvan J Grobler RFP™ (PGDip Financial Planning)

How to invest in a volatile market: 3 Principles to keep in mind ‘In the short term, markets can be very volatile depending on which news story makes headlines. However, over the longer-term investors are always rewarded for staying invested and riding out the waves.’ We know this by now, we have heard it many times before and historical data proves it. Yet it’s easier said than done. When it gets to our own money we are emotionally involved and there is a part of us that believes that this time, it might indeed be different. What if the markets never recover and I suffer permanent capital loss. And with the increase power of AI and social media, it feels like my portfolio hangs on the thread of a single Tweet. In this article Stephen Bernard, an actuarial analyst form our partner Allan Gray share his views, backed by statistics and historical evidence: Read the article here: https://www.allangray.co.za/latest-insights/markets-and-economy/how-to-invest-in-a-volatile-market/

In an increasingly interconnected global economy, South African investors are finding compelling reasons to look beyond local borders when building long-term wealth. Offshore investing offers access to broader, more resilient markets, particularly in developed economies with stronger currencies and more stable political environments. Given South Africa’s constrained economic growth, fiscal uncertainty, and the rand’s vulnerability as an emerging market currency, allocating a portion of your portfolio offshore can serve as both a growth engine and a hedge. Investing offshore provides exposure to world-leading companies, industries, and fund managers that are often unavailable in the local market. It allows investors to participate in innovation-led growth in sectors like technology, healthcare, and clean energy, which are typically underrepresented on the JSE. Most importantly, it supports diversification—not just across asset classes, but across geographies, currencies, and economic cycles—reducing concentration risk tied to the South African economy. Key Reasons to Invest Offshore: Diversification: Reduce reliance on South African markets and benefit from a broader global opportunity set. Currency Hedge: Protect your wealth against rand depreciation by investing in hard currencies. Global Access: Gain exposure to top-tier international asset managers and world-class investments. Growth Potential: Participate in faster-growing economies and industries driving global expansion. Important Considerations for South African Tax Residents Before investing offshore, it’s essential to evaluate how your investment aligns with your broader financial planning, particularly around access, succession, taxation, and estate planning: Flexibility: Will you have access to your funds when needed? What types of investments can you hold? Succession Planning: Can your investment be transferred to your heirs? Will Capital Gains Tax (CGT) apply? Tax Compliance: Is the structure tax-efficient, and what must be declared on your tax return? Estate Structuring: Will your investment attract foreign estate duties? Is an offshore executor required? An Efficient Offshore Solution: The Offshore Wrapper A tailored offshore wrapper can simplify many of these complexities, offering a cost-effective and administratively streamlined solution. Key benefits include: No exposure to offshore estate duties No South African executor fees on death No inheritance tax in the offshore jurisdiction Ability to nominate beneficiaries directly for smooth succession Creditor protection for assets held within the structure Consolidation of various investments (e.g., share portfolios, funds) under one structure Minimum investment from $25,000 Tax Treatment The offshore wrapper also provides significant tax efficiency: Taxes are calculated and settled annually by the platform—no action required by the investor CGT is capped at 12%, and income tax at 30% Taxes are applied to USD returns, meaning rand depreciation is not taxed Reach out to me at ruvan@bovest.co.za for more information. Ruvan J Grobler RFP™ (PGDip Financial Planning)