Blogs

Read our latest news and industry insights.

Ruvan J Grobler

For many professionals, personal savings are what’s left over — if anything is left at all. The data is clear: South Africa’s domestic savings rate remains worryingly low. Even among high-income earners, inconsistent or delayed investing is common. Income alone does not create wealth. Behaviour does. The real risk isn’t lifestyle inflation — it’s time. Missed early contributions cannot be fully recovered later, no matter how high your income becomes. Compounding rewards consistency, not intention. Paying yourself first isn’t about sacrifice; it’s about ensuring today’s success translates into future independence. If Your Business Needs a Budget, So Do You No business operates successfully without a budget. Yet many professionals try to run their personal finances without one. Paying everyone else first — the bank, SARS, suppliers, schools, lifestyle — is what happens when there is no clear structure. Fortunately, a simple framework solves this: the 50/30/20 principle. 50% – Essential Expenses Bond or rent, food, medical aid, school fees, fuel, insurance and other “must-have” costs. 30% – Investments (Your Future Self) Long-term wealth building. Retirement funding. Investments that compound over decades. This allocation happens before discretionary spending. This is how you pay yourself first. 20% – Lifestyle & Discretionary Spending Travel, entertainment, upgrades, dining out and lifestyle enhancements. This framework also brings clarity to big financial decisions. If a new home or vehicle pushes your essential expenses above 50%, it is not affordable — regardless of what the bank approves. Affordability is not what you qualify for. Affordability is what fits sustainably inside your structure. The Cost of Waiting: A Simple Illustration Let’s consider two investors with similar careers and earning potential. Investor A starts investing R15,000 per month at age 30 and contributes for 10 years — stopping at age 40 — but leaves the money invested. Investor B delays saving while focusing on practice expenses and family commitments. At age 40, they begin investing R15,000 per month and continue until age 65 — 25 years of contributions.

Medicine is built on precision, protocols, and evidence-based decisions. Financial life, unfortunately, is not. For many doctors, success arrives early in one area of life and much later in others—time, structure, and strategic planning often lag behind income. Over the years, a few patterns come up repeatedly when working with medical professionals. These are not mistakes born from ignorance or carelessness, but rather from being busy, successful, and focused on patients first. Here are five of the most common financial missteps doctors make—and why addressing them early can materially change long-term outcomes. 1. Being “Cash Heavy” Feels Safe… Until It Isn’t Holding large cash balances is often seen as prudent. Cash is liquid, familiar, and low-stress. For doctors with volatile workloads or private practices, this feels especially comforting. The problem? Cash is one of the most tax-inefficient assets for high earners. While interest income enjoys a modest annual exemption, anything above that threshold is taxed at your marginal rate. For many doctors, this means a significant portion of “safe” interest returns never actually reach them. Add inflation into the mix, and the real (after-tax, after-inflation) return on excess cash can quietly turn negative. Cash has a role—but without intention and limits, it often becomes a silent drag on long-term wealth. 2. Paying More Tax Than Necessary (Without Realising It) Doctors are among the most heavily taxed professionals in South Africa, yet tax planning is often treated as a once-a-year exercise rather than an integrated strategy. The issue isn’t usually under-reporting—it’s under-structuring. Different investment vehicles are taxed in very different ways. Income tax, capital gains tax, and dividend tax don’t just affect returns; they compound over time. Two portfolios with the same gross return can end up worlds apart after tax if they’re structured differently. When investment decisions are made in isolation—without considering tax, time horizon, and estate implications—the cost isn’t obvious in year one. It shows up quietly over decades. 3. Offshore Exposure: Opportunity or Overreaction? Global diversification is important. Offshore exposure can reduce concentration risk and unlock opportunities unavailable locally. However, many investors move money offshore without a clear strategy—often driven by headlines, fear, or currency anxiety rather than long-term planning. Key questions are frequently overlooked: How much offshore exposure is appropriate for your situation? Which structures are most efficient? How does this affect tax, liquidity, and future repatriation? Offshore investing isn’t a binary decision. The value lies in how, where, and through what structure exposure is obtained—not simply in moving money abroad. 4. Paying Everyone Else First Doctors are natural caregivers. Practices, staff, patients, families—everyone’s needs come first. Personal savings often come last. The data is clear: South Africa’s domestic savings rate remains worryingly low. Even among high earners, inconsistent or delayed personal investing is common. The risk isn’t lifestyle inflation—it’s time. Missed early contributions can’t be recovered later, no matter how high income becomes. Compounding rewards consistency, not intention. Paying yourself first isn’t about sacrifice; it’s about ensuring today’s success translates into future independence. 5. Using the Wrong Investment Structures This is arguably the most expensive mistake—and the least visible. Many doctors accumulate investments across multiple platforms, policies, and accounts over time. Each decision may have made sense in isolation, but together they can create inefficiencies around: Tax Access Estate planning Intergenerational transfer The structure holding the investment often matters as much as the investment itself. Over a 20- or 30-year horizon, the difference between “adequate” and “optimal” structuring can be substantial—even if the underlying returns are identical. The Common Thread None of these mistakes stem from poor decision-making. They stem from complexity, time pressure, and the reality that financial planning is a discipline of integration—not isolated choices. Income, tax, investments, offshore exposure, and estate planning don’t operate independently. When aligned, they reinforce one another. When they’re not, value leaks out quietly year after year. For professionals who spend their lives mastering complexity in one field, the challenge is recognising that financial clarity often requires the same level of specialised thinking. Because in finance—just like in medicine—the biggest risks are rarely the obvious ones. Ruvan J Grobler RFP™ (PGDip Financial Planning)

The Bovest Twilight Webinar Series is meticulously designed for medical professionals who are not only clinicians but also business owners. We delve into the crucial aspects of running a successful medical practice, offering actionable business insights and strategies that aren't typically covered in medical school. Each session is fully CPD accredited (10 ethics points), ensuring you earn valuable points while enhancing your practice management skills. Join a community of forward-thinking peers and learn from industry experts to transform your practice into a thriving business. International and local experts in finance, law, strategy, tech and medical marketing come together to reshape the future of private practice. The Bovest Twilight Webinar Series helps doctors turn good ideas into great practices — from first patients to full-scale growth. The series will be hosted in January 2026 supported by APS Africa, LLM Pretorius Davies Inc, Global Z-Data and myMed Marketing. Bovest Wealth Managers, Ruvan J Grobler and PJ Botha will host two sessions: 5 Common Financial Mistakes Doctors Make – 29 January 2026, 18:00-19:00 Estate Planning for Doctors – 12 February 2026, 18:00-19:00 Register at webinars.doceohealth.co.za Ruvan J Grobler RFP™ (PGDip Financial Planning)

It’s often said that the only certainties in life are death and taxes. While it’s not the most cheerful topic, understanding how taxes work when someone passes away can make a difficult time a little less overwhelming. This article aims to unpack the key tax considerations in a straightforward way, so you can plan ahead and ensure the estate is handled efficiently and in accordance with the law but also to give a little perspective on the advice we give as wealth managers. Beneficiaries of deceased estates are often shocked and upset when they see the taxes payable in the estate. Understandable of course, as this eats into their inheritance. Here are a few examples of some of the tax liabilities a deceased estate may face: Estate duty: Levied on the total value of your dutiable estate. 20% levied for deceased estates of more than R3 500 000 and 25% for deceased estates of more than R30 000 000. Transfer Duty: Levied on the transfer of ownership of immovable property from the estate to the beneficiary of the immovable property as set out in the last will. Income Tax: General Income: Income from salaried employment as well as rental income will be taken into account up to the date of death. Can include income earned as a sole proprietor. Income from Investments: This can be in the form of Life- or Living annuity income payments but also interest earnings from discretionary investments or savings vehicles. All rebates and exemptions for the tax year will be apportioned up to date of death. Capital Gains Tax: Capital gains tax can be levied on the gain that arises from the sale of assets to provide cashflow for the estate or beneficiaries. A change of ownership can also trigger capital gains tax. The annual exclusion in the year of death is R300 000 instead of the normal R40 000 annual exclusion. It’s important to plan and make provision for these costs in your estate, there may be more moving parts if the deceased held offshore assets. Here are a few ways to reduce your estate’s tax burden: Acquire (or move) assets through structures like trusts or companies. Invest in tax-efficient discretionary investment structures where the liability is settled in the structure and not in your personal name. Pre- and post-retirement investments do not form part of the dutiable estate if beneficiaries are nominated. No interest earnings- or CGT liabilities are payable on these structures. Ruvan J Grobler RFP™ (PGDip Financial Planning)

In many instances, spouses choose to bequeath their whole estate to each other and the surviving spouse will look after the children. This is also good estate planning. But what will happen to the children and assets should both parents pass away? Underage children can inherit these assets but should be managed through a testamentary trust. A short video summary of the below can be watched here: https://www.instagram.com/reel/DPOqkx3DP1S/?utm_source=ig_web_copy_link&igsh=MzRlODBiNWFlZA== What Is a Testamentary Trust? A testamentary trust is a legal entity created in terms of a person’s Will, which only comes into effect upon their death. Unlike inter vivos trusts, it is not operational during the testator’s lifetime. The Will serves as the trust instrument, and the testator is the founder. How Is It Created? Drafting the Will: The Will must clearly state the intention to create a trust, name the beneficiaries, identify the assets to be placed in trust, and outline the terms and conditions. Activation: Upon death, the nominated trustees apply to the Master of the High Court for Letters of Authority to manage the trust. Trustees: It’s advisable to appoint at least one independent trustee with fiduciary expertise to ensure proper governance. Why Should Clients Consider It? Protection for Minor Children: Minors cannot legally inherit until age 18. A testamentary trust ensures their inheritance is managed responsibly until they reach maturity. Special Needs Planning: A Type A Special Trust offers tax-efficient support for beneficiaries with disabilities. Asset Preservation: Prevents reckless spending by beneficiaries. Trustees manage and distribute assets according to the testator’s wishes. Managing Indivisible Assets: Useful for assets like farms or holiday homes that cannot be easily split among heirs. Tax Efficiency: Testamentary trusts may offer tax advantages, especially in the case of special trusts. Important Considerations Validity of the Will: If the Will is invalid, the trust cannot be established. Professional drafting is essential. Trustee Selection: Trustees must be trustworthy, capable, and ideally include an independent party to avoid conflicts. Costs & Complexity: Testamentary trusts involve legal and administrative costs. Clients should be made aware of ongoing compliance and management responsibilities. Family Dynamics: Clear communication and transparency in the Will can help prevent disputes among beneficiaries. Contact me at ruvan@bovest.co.za for more information. Ruvan J Grobler RFP™ (PGDip Financial Planning)

Debt is often used in case of emergencies but can also be used as leverage to finance the purchase of assets that would otherwise be out of reach. In the case of good- and bad debt, the repayment strategy will help manage cashflow and lower the costs of borrowing. The aim of this article is to help you pay of good debt earlier but may also help those individuals who are under pressure due to debt, to take control of the situation. It is important firstly to have a comprehensive budget that gives a framework for your spending. This helps you keep track of your cashflow and discourages your emotions from taking over. Before taking out any debt, emergency funds and insurance must form part of your plan. Avoid taking out new debt if it does not fit into the current plan and budget. Why it’s important to have a structured plan for repaying debt: Paying more interest over time : Only paying “what you can, when you can,” your payments might be too small or irregular. The debt repayment takes too long, and you pay more in interest. No clear end date : A plan lets you see exactly when you’ll be debt-free, which can be motivating and helps you track progress. Poor prioritisation : Not all debts cost the same. A structured plan ensures you pay off high-interest or priority debts first. Easier budgeting : Knowing exactly how much you’ll pay each month helps you manage cash flow and identify opportunities for extra repayments. Better discipline and accountability : A structures plan helps to remove any guesswork and prevents emotional spending or skipping of any payments. Repayment Strategies: Snowball Method How it works: List debts from smallest to largest balance. Pay minimums on all and put any extra money into smallest debts first. Positive: Quick wins from paying off small debts early give motivation to keep going. Negative: You might pay more interest over time compared to other methods. Avalanche Method How it works: List debts by interest rate, highest first. Pay minimums on all and put extra money toward the highest-interest debt. Positive: Saves the most on interest and often pays off debt faster overall. Negative: May take longer to see your first “win,” which can be demotivating for some. Debt Consolidation How it works: Combine multiple debts into a single loan (often at a lower interest rate). This could be a personal loan, balance transfer credit card, or home equity loan. Positive: Simplifies payments into one bill and can reduce interest costs. Negative: If you keep borrowing after consolidating, you could end up in deeper debt. Refinancing How it works: Replace an existing loan (e.g., bond, car loan) with a new one at better terms. Positive: Can lower monthly repayments and interest. Negative: Extending the term may cost more in interest over the long run. Ruvan J Grobler RFP™ (PGDip Financial Planning)

Your estate plan evolves as you get older and regular revision of beneficiary nominations on appropriate investments structures becomes a key planning tool. A holistic financial plan is the roadmap to executing these essential estate planning decisions. Let’s explore the importance of beneficiary nominations on your retirement annuity, pension-, provident or preservation funds. Estate Planning: Availability of funds: If the beneficiary nomination is valid, the death benefit will flow directly from the insurer to the beneficiary. This process can be much quicker than the process of winding up the estate. The death benefit can be paid to beneficiaries before other distributions from the estate is made. Estate related fees: By nominating valid beneficiaries, there is no capital inclusion in the deceased’s estate for estate duty and executor fees. This makes it an effective planning tool in reducing the size of the estate and related fees. Estate duty (SARS): 20% of the dutiable estate after R3.5mil and 25% after R30mil. Executor’s fees: Maximum of 4.025% (Including VAT) of the deceased estate. Very Important note: Section 37C of the Pension Funds Act regulates the payment of death benefits. The act aims to identify dependants of the deceased and ensure that death benefit payments are made to them. The trustees appointed by the fund must identify these dependants irrespective of who was nominated by the deceased. The trustees have a duty to conduct a thorough investigation to ensure equitable distribution of death benefits and rely on the financial advisor to provide relevant facts. What if no beneficiaries are nominated? The above process will still follow but it could then be possible that a determination is made to pay the death benefit to the deceased’s estate. The capital will then form part of the estate for purposes of estate duty and executor’s fees. This may also be an intentional decision in order to provide cashflow in the estate for estate related costs or debt. There are however better options in planning for estate cashflow needs. The above is not financial advice and serves only as factual information. Make sure these nominations align with your long-term financial goals and estate planning by consulting with your financial advisor. Ruvan J Grobler RFP™ (PGDip Financial Planning)

In an increasingly interconnected global economy, South African investors are finding compelling reasons to look beyond local borders when building long-term wealth. Offshore investing offers access to broader, more resilient markets, particularly in developed economies with stronger currencies and more stable political environments. Given South Africa’s constrained economic growth, fiscal uncertainty, and the rand’s vulnerability as an emerging market currency, allocating a portion of your portfolio offshore can serve as both a growth engine and a hedge. Investing offshore provides exposure to world-leading companies, industries, and fund managers that are often unavailable in the local market. It allows investors to participate in innovation-led growth in sectors like technology, healthcare, and clean energy, which are typically underrepresented on the JSE. Most importantly, it supports diversification—not just across asset classes, but across geographies, currencies, and economic cycles—reducing concentration risk tied to the South African economy. Key Reasons to Invest Offshore: Diversification: Reduce reliance on South African markets and benefit from a broader global opportunity set. Currency Hedge: Protect your wealth against rand depreciation by investing in hard currencies. Global Access: Gain exposure to top-tier international asset managers and world-class investments. Growth Potential: Participate in faster-growing economies and industries driving global expansion. Important Considerations for South African Tax Residents Before investing offshore, it’s essential to evaluate how your investment aligns with your broader financial planning, particularly around access, succession, taxation, and estate planning: Flexibility: Will you have access to your funds when needed? What types of investments can you hold? Succession Planning: Can your investment be transferred to your heirs? Will Capital Gains Tax (CGT) apply? Tax Compliance: Is the structure tax-efficient, and what must be declared on your tax return? Estate Structuring: Will your investment attract foreign estate duties? Is an offshore executor required? An Efficient Offshore Solution: The Offshore Wrapper A tailored offshore wrapper can simplify many of these complexities, offering a cost-effective and administratively streamlined solution. Key benefits include: No exposure to offshore estate duties No South African executor fees on death No inheritance tax in the offshore jurisdiction Ability to nominate beneficiaries directly for smooth succession Creditor protection for assets held within the structure Consolidation of various investments (e.g., share portfolios, funds) under one structure Minimum investment from $25,000 Tax Treatment The offshore wrapper also provides significant tax efficiency: Taxes are calculated and settled annually by the platform—no action required by the investor CGT is capped at 12%, and income tax at 30% Taxes are applied to USD returns, meaning rand depreciation is not taxed Reach out to me at ruvan@bovest.co.za for more information. Ruvan J Grobler RFP™ (PGDip Financial Planning)

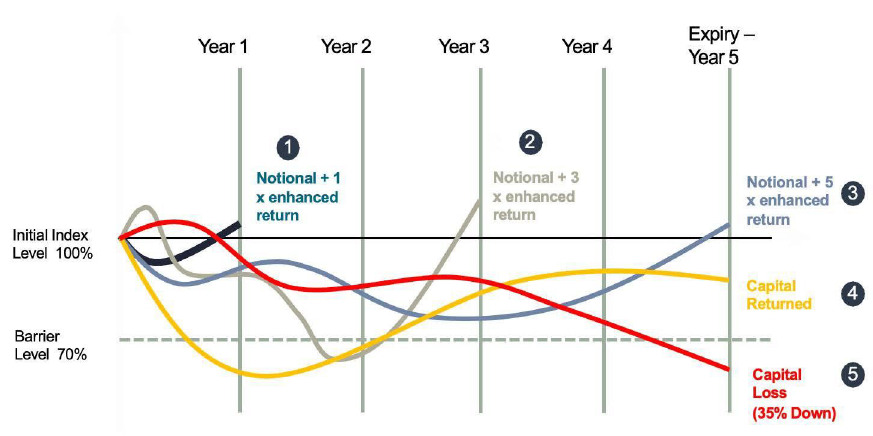

Structured Investments are pre-packaged investment strategies with predetermined payouts and can be linked to a variety of underlying assets (e.g., equities, indices, commodities, or currencies). Some structured products include downside protection, which can cushion losses in adverse market conditions. By diversifying into different protection levels and structures, you can tailor the risk exposure of your overall portfolio. An autocall investment is a structured note that can end early if the linked index, like the Nikkei 225 or Euro Stoxx Select 30 Dividend Index, performs well enough. It runs for a fixed period of five years but is reviewed once a year. If the asset is at or above a certain level on a review date, the note "autocalls": it ends, you get your original money back, plus a set return. If it doesn’t autocall, it keeps going. At the end, if the asset hasn’t fallen too far, you still get your money back. But if it has dropped below a certain threshold, you could lose money based on how much it fell. Who is this for? Investors looking for offshore exposure with a level of capital protection. Minimum R100 000. Credit risk: Structured products are often issued by banks or financial institutions. Spreading investments across different issuers can reduce exposure to the credit risk of any one issuer. In this example Investec is the issuer, but the credit reference can be any of the following: Commerzbank AG, Credit Agricole, BNP Paribas SA. Protection: In this example, 100% capital protection in Rand provided the index does not end below 70% of Initial Index Level.

Is retirement an out-of-date pipedream? With rising living costs and economic uncertainty in South Africa, it’s not surprising that people feel this way. But what we see as “retirement” is changing, the traditional retirement age of 65 has already started to look different because people live longer. We live in a time where passive income and part-time work is as easy as ever and done from anywhere. Although retirement is continually evolving it still is more important than ever to start investing as early as possible and stay consistent over the long-term. Employer matching your pension contributions, should you max it out? Yes definitely. It’s free investment allocations and effectively instantly doubles your contributions. The higher the contributions, the better the compounding effect of the capital. You can also deduct your employer’s contributions together with your own contributions in your annual income tax returns. Are there other ways to supplement your retirement income? There are many discretionary investment structures (non-retirement) that hold massive tax-and estate planning benefits. It's always a good idea to diversify in the structures that you use to invest because they can be so different. This is true for the actual assets as well, never have your eggs in one basket. Building a business or renting out property can also be effective but holds it’s own risks. Should you pick the most aggressive investment option for retirement? If you have time on your side, going more aggressive is the optimal long-term strategy if you can stomach short-term volatility in assets like shares. In South Africa, all pre-retirement structures must adhere to Regulation 28 of the Pension Funds Act and this does limit the level of risk you are able to take with your retirement funds, but alternative structures can supplement your risk appetite. Time in the market is always better than trying to time the market. What are common retirement investment mistakes? Starting too late. Not saving enough, at least 20% of your monthly income should be invested. Regularly switching between different funds and assets due to short-term volatility (bad investor behaviour). A lack of diversification. Failing to adjust your plan as you go – marriage, kids and inflation play a role. Ruvan J Grobler RFP™