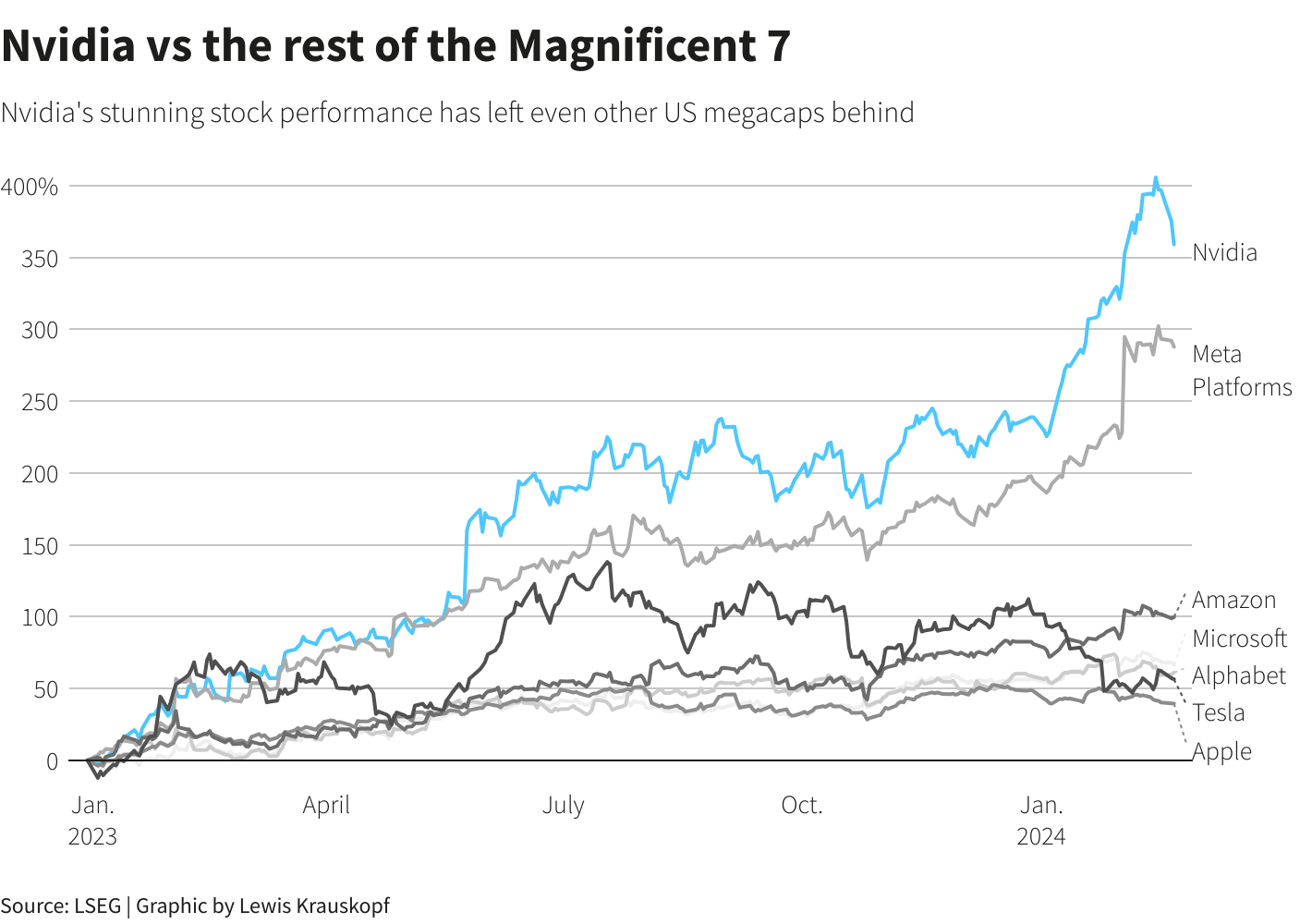

Nvidia – The Magnificent 1

"Shares like Nvidia can form part of a well-diversified investment portfolio where market risk is managed."

The S&P reached an all-time high following Nvidia’s historic surge in market value. Nvidia reported a staggering 265% revenue growth in the fourth quarter, with projections of even stronger earnings this quarter due to increasing demand for its AI chips. The single-day market cap gain of $277 billion eclipsed Meta’s $196 billion gain earlier in the month.

At 27/02/2024 Nvidia is $793.20 per share, up 240% the past year. Will this trend stick forever? Certainly not. As we saw with Tesla (although vastly different) since January 2023 they are down 19.75%. I do still see value going forward in Nvidia, but there are many other that offer value. Don’t fall in love with a single share.

There will always be companies and funds that outperform their peers at a certain time. Although predictions and projections can be made by analysts, there is no crystal ball that can tell us when to buy and when to sell. There is always risk and a bit of luck involved.

No fund or institutional investor holds only one share, the risk is simply too high. A diversified portfolio consists of assets from different industries, sectors, and geographic areas, each with their own investment horizon. Shares like Nvidia can form part of a well-diversified investment portfolio where market risk is managed.

What do you need to take into account with your portfolio?

– Amount invested

– Investment horizon

– Investment goals

– Risk tolerance

– Liquidity

– Estate planning

– Tax planning

Using the above variables should give you a framework for the type of assets you can invest in to diversify your portfolio. Giving it building blocks to protect against short-term volatility, but also growth assets that increase your net-worth above inflation.

*This does not serve as financial advice.

Ruvan J Grobler RFP™

Start Investing Today

We will get back to you as soon as possible.

Please try again later.

HEAD OFFICE

Menlyn Corporate Park, Block C

175 Corobay Avenue, Waterkloof Glen, Pretoria

012 998 6428

NAVIGATION

©COPYRIGHT BOVEST. ALL RIGHTS RESERVED. BOVEST WEALTH MANAGEMENT PTY (LTD) IS AN AUTHORISED FINANCIAL SERVICES PROVIDER FSP Nr. 35064